Analysis and Anticipation on Chinese Medium Truck Market in Q3 2013

1. Analysis on production and sales in first three quarters

Statistics released by CAAM that production and sales volume of trucks are 2,608,433 and 2,633,069 respectively from January to September, up by 8.90% and 7.33% year on year.

Seen from the detailed truck market, all of them enjoy growth; heavy truck grows by 15.30%, medium truck 10.27%, light truck 5.85% and micro truck 1.08%. With respect to market share, light truck accounts for 54.75%, heavy truck 21.54%, micro truck 15.28% and light truck 8.42% (see table 1).

In the third quarter of 2013, the sales volume of trucks (including chassis and semi-tractors) is 783,409 units, up by 10.97% year on year. Heavy truck grows at the fastest pace with the growth rate reaching 36.73%, and light truck 7.75%, followed by medium truck 1.96%. In terms of market share, light truck takes up 55.88%, heavy truck 21.00%, micro truck 15.15% and medium truck 7.97%. Regarding to proportion of Q3 in total sales of first 9 months, light truck accounts for 30.36%, micro truck 29.50%, heavy truck 29.01% and medium truck 28.16%.

In the above rankings, medium truck always stays at the last position.

Table 1 Sales of Chinese trucks from Jan.-Sep. 2013 (units, %)

|

Category

|

Sales Jan.-Sep.

|

Growth rate over last year

|

Market share

|

Sales Q3

|

Growth rate over last year

|

Proportion of Q3

|

Growth rate of proportion of Q3

|

Proportion of Q3 in first 9 months

|

Proportion growth rate

|

|

Truck (including chassis, semi-tractors)

|

2633069

|

7.33

|

100.00

|

783409

|

10.97

|

100.00

|

0.00

|

29.75

|

0.98

|

|

HD truck (including chassis and semi-tractors)

|

567209

|

15.30

|

21.54

|

164530

|

36.73

|

21.00

|

3.96

|

29.01

|

4.55

|

|

MD truck (including chassis)

|

221804

|

10.27

|

8.42

|

62466

|

1.96

|

7.97

|

-0.70

|

28.16

|

-2.29

|

|

LD truck (including chassis)

|

1441735

|

5.85

|

54.75

|

437731

|

7.75

|

55.88

|

-1.67

|

30.36

|

0.54

|

|

Micro truck (including chassis)

|

402321

|

1.08

|

15.28

|

118682

|

0.48

|

15.15

|

-1.58

|

29.50

|

-0.17

|

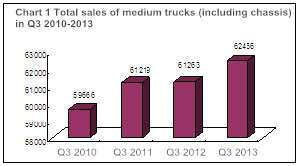

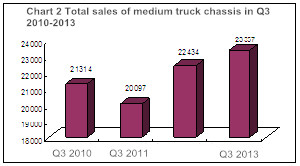

In the third quarter, due to high temperature and the demand for cooling, the usage of electricity increases dramatically. The transportation for cold chain product rises as well. The sales volume of medium trucks (including chassis) hits a historical high (see Chart 1) thanks to many favorable factors such as the upgrading of urban environment protection, state and local regulation on much trucks and logistic market, reconstruction of drought and waterlog areas, and increase of investment in infrastructure. In the same way, Chinese medium truck chassis also witnesses a new high compared with the same period in the past four years (see Chart 2).

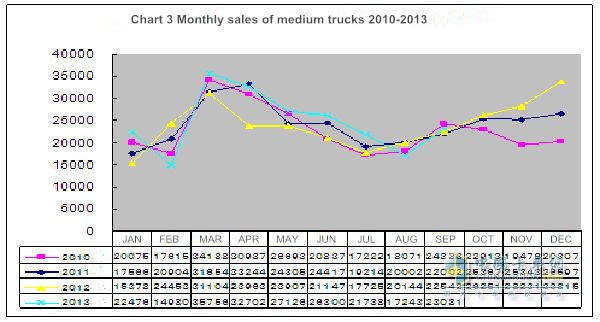

The medium market undergoes ups and downs in Q3. In July, the sales volume hits a new high compared with the same period in 4 years, but it suffers an extreme low over the same period in the past 4 years. In September the sales rise a little bit higher than the same period of 2011 and 2012, but still lower than the same period of 2010 (see Chart 3).

2. Analysis on medium truck

1) Analysis in the first three quarters

From January to September, 2013, the data from CAMA shows there are 19 enterprises producing medium trucks, 1 enterprise less than the same period of last year and Tri-Ring Hanyang Special Vehicle quitted this market (see Table 2).

Dongfeng remains the leader of this market relying on 61387 units and 27.68% market share. The sales volumes of complete vehicles and chassis are 21347 units and 40040 units respectively, up by 1.88% and 10.43% year on year, contributing 34.77% and 65.23% to the total sales volumes in the first three quarters. The total sales volume is 24,000 units higher than the No.2, FAW Jiefang, and the market share is 11% higher.

FAW Jiefang sells 36673 units of medium trucks, up by 17.10% year on year with a market share of 16.53%. The sales volume of complete vehicle and chassis is 1424 units and 35249 units, with year-on-year growth rate -58.12% and 26.26%, contributing 3.88% and 96.12% to the total sales in the first three quarters.

After one year quiet adjustment, Sinotruk ushers in rapid development with the increasingly mature production base for medium trucks in Chengdu, Haixi and Shandong thanks to the improvement of technology, market, product and network of its medium truck products. It sells 24792 units, up by 52.14% year on year with a market share of 11.18%, 3.08 percentage points higher than Q3 of last year.

Chongqing Lifang sells 18871 units, up by 20.74% year on year with a market share of 8.51%.

Jinbei sells 12830 units with a market share of 5.78% and 200.26% growth rate year on year. The market share is 3.66 percent higher than that in the same period of last year. JAC, after completing product integration and technological upgrade, also welcomes a rapid increase by selling 12320 units with a year-on-year growth of 20%. Foton Ollin has been raising attention on medium truck market since the beginning of 2013 by integrating and upgrading products in Foton headquarters and launching new products. Finally its medium truck product grows by 98.31% to 9245 units with market share 2 percents higher.

The slump of medium truck market in 2013 makes Sichuan & Chongqing enterprises and Shandong enterprises suffer severe decrease. Among Sichuan & Chongqing enterprises, Qingling, whose main medium trucks are mainly high-level, suffers a decrease of over 15%; Nanjun, affected by the acquisition of Hyundai, suffers a decline of over 27%; Chengdu Dayun even sees a drop over 60%. With respect to Shandong enterprises, Tangjun Ouling suffers a decline of 31.33%, KAMA declines by 28.13% and Wuzheng Feidie declines by 24.93%.

Table 2 Sales of medium trucks (including chassis) of Chinese manufacturers from January to September (Unit, %)

|

Rank

|

Enterprise name

|

Sales Jan.-Sep.

|

Yearly growth rate

|

Market share

|

Growth rate of market share

|

Sales in Q3

|

Yearly growth rate

|

Proportion of Q3 in first three quarters

|

Growth rate of proportion

|

|

Total medium trucks (including chassis)

|

221804

|

10.27

|

100.00

|

0.00

|

62466

|

1.96

|

28.16

|

-2.29

|

|

|

1

|

Dongfeng

|

61387

|

7.30

|

27.68

|

-0.77

|

14048

|

-10.40

|

22.88

|

-4.52

|

|

2

|

FAW

|

36673

|

17.10

|

16.53

|

0.96

|

11656

|

21.38

|

31.78

|

1.12

|

|

3

|

Sinotruk

|

24792

|

52.14

|

11.18

|

3.08

|

6012

|

26.68

|

24.25

|

-4.88

|

|

4

|

Chongqing Lifan

|

18871

|

20.74

|

8.51

|

0.74

|

7833

|

-7.20

|

41.51

|

-12.50

|

|

5

|

Qingling

|

13164

|

-15.26

|

5.93

|

-1.79

|

4045

|

-24.31

|

30.73

|

-3.67

|

|

6

|

Jinbei

|

12830

|

200.26

|

5.78

|

3.66

|

4464

|

1388.00

|

34.79

|

27.77

|

|

7

|

JAC

|

12320

|

19.01

|

5.55

|

0.41

|

3246

|

24.27

|

26.35

|

1.12

|

|

8

|

Sichuan Hyundai

|

10841

|

-27.40

|

4.89

|

-2.54

|

2742

|

-14.63

|

25.29

|

3.78

|

|

9

|

Foton

|

9245

|

98.31

|

4.17

|

1.85

|

2700

|

-19.04

|

29.2

|

-42.33

|

|

10

|

Shandong Tangjun Ouling

|

7894

|

-31.33

|

3.56

|

-2.16

|

1899

|

-44.83

|

24.06

|

-5.88

|

|

11

|

Zhejiang Feidie

|

4819

|

-24.93

|

2.17

|

-1.02

|

1702

|

-4.49

|

35.32

|

7.56

|

|

12

|

Hubei Tri-Ring Special Vehicle

|

3306

|

25.32

|

1.49

|

0.18

|

658

|

23.68

|

19.9

|

-0.26

|

|

13

|

Shandong KAMA

|

1875

|

-28.13

|

0.85

|

-0.45

|

373

|

13.72

|

19.89

|

7.32

|

|

14

|

YTO

|

1792

|

-42.17

|

0.81

|

-0.73

|

595

|

-40.44

|

33.2

|

0.97

|

|

15

|

Chengdu Dayun

|

1135

|

-62.13

|

0.51

|

-0.98

|

284

|

-48.55

|

25.02

|

6.60

|

|

16

|

Fujian New Long Ma Motors

|

365

|

-38.76

|

0.16

|

-0.13

|

92

|

5.75

|

25.21

|

10.61

|

|

17

|

Shacman

|

281

|

-46.78

|

0.13

|

-0.14

|

65

|

-63.89

|

23.13

|

-10.96

|

|

18

|

Jingdong Zhenjiang

|

193

|

-29.56

|

0.09

|

-0.05

|

50

|

-3.85

|

25.91

|

6.93

|

|

19

|

Hubei Sanjiang Space

|

21

|

5.00

|

0.01

|

0.00

|

2

|

-75

|

9.52

|

-30.48

|

In terms of ranking, in the first three quarters of 2013, ranks of enterprises are changed a little bit. The top five remain the same. There are three enterprises get a rise and three get a decline. Dongfeng, FAW, Sinotruk, Lifang and Qingling maintain their own position from No.1 to No.5. Jinbei rises to No.6 from No.11 of last year, JAC rises to No.7 from No.8 of last year, and Foton rises to No. 9 from No.10 of last year. The three enterprises going down are: Sichuan Hyundai drops to No.8 from No.6 of last year, Tangjun Ouling drops to No.10 from No.7 of last year and Zhejiang Feidie drops to No.11 from No.9 of last year.

2) Competitive analysis in Q3

In the third quarter, seven medium truck manufacturers enjoy remarkable growth while fourteen manufacturers perform less well (see Table 2). FAW sells 11656 units up by 21.38% year on year; Sinotruk 6012 units, up by 26.68% year on year; Jinbei 4464 units, up by 1388.00%; and JAC 3246 units, up by 24.27%. The above four enterprises earn a lot of fortune in the third quarter. By contrast, seven manufacturers see negative growth rate and even drop dramatically, namely Dongfeng (selling 14048 units, down by 10.40% year on year), Lifan (7833 units, down by 7.20%), Qingling (4045 units, down by 24.31%), Sichuan Hyundai (2742 units, down by 14.63%), Foton (2700 units, down by 19.04%), Tangjun Ouling (1899 units, down by 44.83%) and Feidie (1702 units, down by 4.49%).

In terms of ranking, besides Jinbei and Qingling shift their rank, the rest manufacturers maintain the position with that in the first three quarters.

With respect to the total sales volume, there are 6 manufacturers whose 30% of sales in the first three quarters are completed in the third quarter, namely Lifang (sales in Q3 contributing 41.51% to overall sales in the first three quarters), Feidie, (35.32%), Jinbei (34.79%), YTO (33.20%), FAW (31.78%) and Qingling (30.73%). There are 10 manufacturers whose 20% of total sales in Q1, Q2 and Q3 are completed in Q3. Dongfeng completes 22.88% of total sales in the first three quarters, Sinotruck 24.25%, JAC 26.35%, Foton 29.20%, Sichuan Hyundai 25.29% and Tangjun Ouling 24.06%.

3) Competitiveness analysis on medium truck chassis

According to statistics of CAAM regarding the production of medium truck chassis in first three quarters, there are only 4 manufacturers namely Dongfeng, FAW, Qingling and Foton. Dongfeng sells over 40,000 units of medium truck chassis, up by over 10% year on year and market share over 46%, 0.71 percentages lower than that in last year. FAW sells over 35,000 units, up by over 26% and market share 40.90%, 4.58 percentages higher than that in last year. Qingling suffers decrease in both sale volume and market share. The sales volume declines by 13.81% and the market share drops 3.56 percentages (see Table 3).

Table 3 Sales of medium truck chassises from Jan. to Sep. 2013 (Units, %)

|

Rank

|

Company name

|

Sales Jan-Sep

|

Growth rate over last year

|

Market share 2013

|

Growth rate over last year

|

Sales in Q3

|

Growth rate over last year

|

Proportion of sales in Q3 in first three quarters

|

Growth rate of proportion of Q3

|

|

Total chassis

|

86179

|

12.11

|

100.00

|

0.00

|

23357

|

4.11

|

27.10

|

-2.08

|

|

|

1

|

Dongfeng

|

40040

|

10.43

|

46.46

|

-0.71

|

9432

|

-4.89

|

23.56

|

-3.79

|

|

2

|

FAW

|

35249

|

26.26

|

40.90

|

4.58

|

10842

|

28.11

|

30.76

|

0.44

|

|

3

|

Qingling

|

10202

|

-13.81

|

11.84

|

-3.56

|

3030

|

-24.17

|

29.70

|

-4.06

|

|

4

|

Foton

|

667

|

15.60

|

0.77

|

0.02

|

51

|

142.86

|

7.65

|

4.01

|

In Q3, the total sales volume of medium truck chassis is 23357 units, up by 4.11% year on year. The whole market sees two manufacturers increase while two decrease. FAW sells 10842 units of medium truck chassis, up by 28.11% year on year, ranking first in terms of growth rate in Q3. The sales volume in Q3 accounts for 30% in total sales volume in Q1, 2 and 3. Dongfeng sells 9432 units, down by 4.89% year on year. The proportion of sales in Q3 takes up 23.56% in sales of Q1, 2 and 3. Qingling sells 3030 units, down by 24.17% and the sales proportion in Q3 is 29.70%.

3. Analysis on market characteristics

Since the beginning of 2013, the market has been presenting the following characteristics:

1) Market demands continue to grow. In the third quarter, the sales of medium truck (including chassis) and medium truck chassis both hit a high over the past four year.

2. Dongfeng and FAW continue to steer the market direction. Their positions in medium truck chassis market remain unshakable but their competitiveness is shrinking in the complete medium truck segment. In the same way, Qingling and FAW Jiefang also witness an increasingly weak competitiveness. On the contrary, thanks to constant integration and improvement in products, marketing and network as well as launching of new high-level products, JAC, Sinotruk and Foton are seeing a more and more competitive strength. Jinbei also increases competitiveness.

3) The launching of new products is slowing down, but the new high-level products come out one after another. Since the beginning, five enterprises (Foton, Sichuan Hyundai, Tangjun Ouling, FAW and Sinotruk) in succession launch 7 series of new products, 4 of them are high-level ones. To name a few, Auplead medium truck launched by Dayun on March 29; Aumark 5 launched by Foton on March 31; Foton Rowo (Cummins engine) rolled out in Beijing on September 11; MIGHTY launched by Sichuan Hyundai at Chengdu Century International Convention Center from August 30 to September 8; T6 by Tangjun Ouling released at the beginning of 2013; FAW Jiefang Qingdao Long V rolled out in Beijing on September 23; New Yellow River delivered by Sinotruk to users on June 8.

4) Medium trucks with high tonnages and low tonnages grow fastest. According to statistics of CAAM, from January to August, 2013, 28346 units of high tonnage (12t<gross mass≤14t) medium trucks are sold, up by 41.13% year on year, while 59515 units of low tonnage (6t<gross mass≤8t) are sold, up by 19.22% year on year. The sales of those with tonnage in the middle decrease very fast. 19855 units of medium trucks with tonnage 8t<gross mass≤10t are sold, down by 12.2% year on year, while 14689 units of medium trucks with tonnage 10t<gross mass≤12t are sold, down by 17.35% year on year.

4. Anticipation on the market in 2013

Looking into the whole market, the total production will reach 89,000 units in Q4, leveling off with the same period of last year. The total sales in the whole year will be 310,000 units, up by 7% or so year on year.

The main factors affecting the medium truck market in Q4 are mainly as follows except for economic recovery.

Firstly, based on the policies launched, the urban environmental protection will be accelerated in 2013 and key cities will speed up upgrading of high-emission vehicles in Q4.

Secondly, the year-end performance appraisal on local governments is counted down by the end of the year. Many local governments especially those of key cities will increase monitor and regulation on muck trucks and overrun vehicles, thus raising new demands for transportation vehicles.

Thirdly, as the urbanization construction goes forward, the city building in some mountainous areas will bring more needs.

Fourthly, post-disaster reconstruction will also brings in more demands because of draughts, waterlogging, typhoon and other disasters in some areas in the second half year.

Fifthly, the transportation of vegetables from south to north will contribute to the increasing demands for trucks.

Sixthly, the backward production elimination comes to a key stage in Q4. The shutdown of enterprises related to industries of iron & steel, cement, non-ferrous, petrochemical, mechanical, building materials, textile and light chemical will affect the freight volume in these industries.

Seventhly, with the end of national wide 6-month unlawful acts of trucks, the transportation market is full of vitality again.

Eighthly, in responding to China Ⅳ emission standard, the presale of China 3 trucks before June is basically finished in September. Entering October, the implementation of China Ⅳ in most cities will definitely affect the sales of new trucks.

- JAC to Launch Its First Shuailing 18-ton Medium-duty Truck in China 2018-10-16

- Medium-sized Trucks Sold 21,133 Units in November 2017-12-13

- VW Teams Up with Navistar to Introduce Medium-Duty Electric Truck in 2019 2017-09-30

- Top 10 Sales Ranking for Medium Duty Truck in May, 2017 2017-06-15

- Top Ten Rankings for Medium Trucks in April, 2017 2017-05-16

- Medium Truck Sales Ranking Released in January 2017 2017-02-15

- The Sales Report of Medium Trucks in November Released 2016-12-19

- Lifan Ranked No.1 in the October Medium Trucks Sales Ranking 2016-11-17

- Production and Sales Analysis of Medium and Heavy Trucks in April 2015-05-19

- Production and Sales of Medium Trucks and Heavy Trucks in February 2015-03-13

Submit Your Requirements, We Are Always At Your Service.

- Zhizi Auto Successfully Holds 2025 Product Launch Event

- FAW Jiefang and CATL Sign Strategic Partnership Agreement

- Driving Green Economy Forward: ABA Bank Partners with ZO Motors Cambodia

- Farizon SV Sets New Safety Standard with Euro NCAP Platinum Rating

- Chery Commercial Vehicles Launches New Heavy Truck Platform

- JAC Listed on China’s Top 100 Global Brands

- FAW Jiefang Strengthens Global Reach with a Focus on Uzbekistan

- COMTRANS 2024 Opens in Moscow

- JAC Advances in Australia: Expanding Electric Trucks in 2024

- Foton Launches “IECO” Brand: A New Era for Smart CV Ecosystem

- November 2024: Heavy Truck Sales Hit New Highs

- November 2024: New Energy Light Truck Sales Hit 14,000 Units in China

- November 2024 Sees Surge in New Energy Heavy Trucks in China

- Heavy Truck Sales Reached 56,000 units in First Three Quarters 2024

- Heavy Truck Sales in September 2024

- Heavy Truck Sales Reach 59,000 Units in July in China

- Tractor Sales in H1, 2024 Reached 162,100 Units, Up 4%

- China's Truck Export Reaches 351,076 Units in H1 2024

- XCMG Dominates 2024 with Record Sales in New Energy Heavy Trucks

- Mid-Year Pickup Market Report: JAC Exports Up 13%, JMC Exceed 36,000 Units