Analysis and Prediction on Light Truck Market in Q2 2013

www.chinatrucks.com: In the first half 2013, Chinese commercial vehicle market remains to maintain a slow rising status despite of many negative factors such as slowdown of Chinese economic development, upgrading of emission standard, driving limits of trucks, elimination of yellow label cars (referring to vehicles emitting highly polluted gas), updates of vehicles bought before 2010, release of some oppressive market, transportation market improvement and rectification.

Ⅰ.Production and sales

According to statistics of CAAM, from Jan. to Jun. 2013, both production and sale of China’s commercial vehicle outnumber 2 million units, 2087181 units and 2117142 units respectively, and up by 8.15% and 6.68% in respective. Both production and sale of trucks (inc. non-complete vehicle and semi tractor) exceed 1.8 million units, reaching 1819855 units and 1849660 units with year-on-year growth up by 7.44% and 5.86% respectively.

The truck market in the first half year presents a “two highs and two lows” trend in terms of sales. The sales volume of heavy and medium truck grows higher than that of the whole truck market, and light and micro truck increases lower than the whole market. With respect to market share, the light truck remain takes up half of the market, but decreasing by 0.42% year on year; while heavy and medium trucks all sees a 0.5% increase in market share over last year (see table 1).

Table 1 Sales of various truck products from Jan. to Jun. 2013 (unit, %)

|

Product type

|

Sales Jan.-Jun. 2013

|

Year-on-year growth

|

Market share

|

Sales in Q2 2013

|

Market share

|

Sales in Q2 2012

|

Year-on-year growth in Q2

|

|

Total trucks (inc. chassis and tractors)

|

1849660

|

5.86

|

100

|

964572

|

100

|

837696

|

15.15

|

|

HD trucks (inc. chassis and tractors)

|

402679

|

8.36

|

21.77

|

233908

|

24.25

|

168173

|

39.09

|

|

MD trucks (inc. chassis)

|

159338

|

13.91

|

8.61

|

86134

|

8.93

|

68862

|

25.08

|

|

LD trucks (inc. chassis)

|

1004004

|

5.04

|

54.28

|

513308

|

53.22

|

465344

|

10.31

|

|

Micro trucks (inc. chassis)

|

283639

|

1.33

|

15.33

|

131222

|

13.6

|

168173

|

-3.03

|

In Q2, other sector all see rapid growth except the micro truck, the sales volume of which is down by 3.03% year on year. The heavy truck grows by 39.09% year on year, medium trucks by over 25% and light truck over 10% (see Table 1).

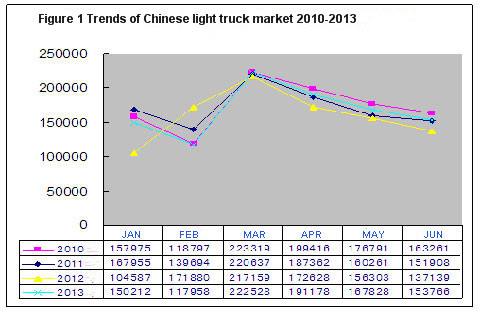

Looking at the monthly trend, in the first half year, the total light truck market mainly follows the tracks in the same period of 2010 and 2011. In Jan. and Feb., the sales volumes are both lower than the same period in 2010 and 2011; sales volumes in Mar., Apr., May and Jun. are between the monthly sales in 2010 and 2011, meaning, the sales volume in the above four months is lower than the same month in 2010 but higher than the same month in 2011 (see Figure 1).

Compared with the first half year of 2012, the sales volumes in Jan., Mar., Apr., May and Jun. are higher than the same month but in Feb., the sales volume is lower than the same month in 2012 due to Spring Festivals. This shows that the market demands in the first half of 2013 is raising.

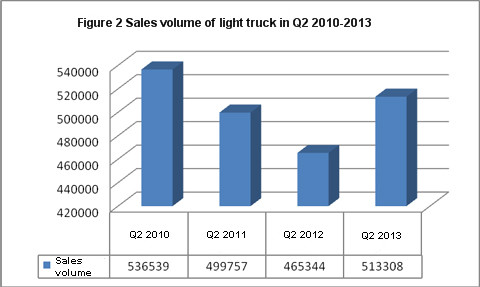

Reviewing the sales in Q2 in the past 4 years, in Q2 2010, the sales volume of light truck reaches a new high, totaling 530,000 units thanks to favorable policies such as implementation of fuel oil tax, rise of purchase tax, extension of duration of Rural Car Purchase Subsidy Program, subsidy of old for new, etc. (see figure 2).

In Q2 2011, the sales volume of light truck drops to 490,000 units affected by various reasons, such as the state’s intensification on water conservancy projects, approval of large amount of government-subsidized housing units, retreat of Rural Car Purchase Subsidy Program, strengthening of vehicle monitoring, implementation of fuel consumption access policy, draught, bloods, earthquakes, inflation, appreciation of RMB, main importers’ war and boundary disputes, etc.

In Q2 2012, the sales volume of light truck again sees a dramatic fall, 30,000 units fewer than Q2 2011. This is because China encounters challenges both at home and abroad. Internationally, the periphery economy is weak due to European debts crisis, frictions with surrounding countries never stops and the dispute on South China Sea is intensified. In domestic market, investment, trade and consumption suffer slowdown.

In Q2 2013, the depressed market is partially released: many vehicles bought in 2010 need to be upgraded. Coupled with favorable factors like emission upgrading in different cities, the total sales volume of light truck soars to 513,000 units, 48,000 units more than that in Q2 2012, and 23,000 units less than that in Q2 2010.

Ⅱ. Market Competition

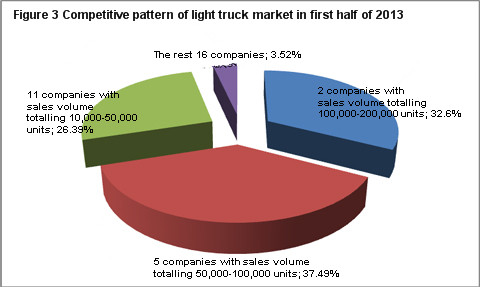

In the first half 2013, according to statistics of CAAM, 34 companies have sales of light trucks (2 companies more over the same period of last year). 2 companies see a total sales volume surpassing 100,000 units—Foton and JAC, 203943 units and 123365 units with growth rates of -3.47% and 8.23% in respective. The two companies account for almost 1/3 light truck market, totaling 32.60%, up by 0.63% year on year (see Figure 3). Foton’s market share is down by 1.79% but JAC’s share is up by 0.36% (see Table 2).

Dongfeng, Jinbei, JMC, GWM and NAC are five companies with sales volume between 50,000 units and 100,000 units. Last year, there are only four companies. NAC squeezes into this camp relying on a 26.5% growth rate. The total sales volume of the five companies reaches 376386 units, up by 5.66%. The total market share of the five companies is 37.49%. Among the five, Jinbei grows the fastest, 15.84%. JAC’s growth rate exceeds 3%, while Dongfeng and GWM’s growth rate decreases by 3%.

11 companies whose sales volume between 10,000 units and 50,000 units sell 264994 units in total, up by 9.28%. The market share of the 11 companies is 26.39%, up by 1.02% year on year. FAW, ZX Auto and Tangjun Ouling see a growth rate higher than 10%, Lifan Auto and Changan over 80%. Sichuan Nan Jun, due to a new company restructuring with HONDA, and BAIC, due to new location and trial production, witness dramatic decline in sales volume year on year, -33.74% and -28.00% respectively.

The rest 16 companies sell 35316 units in total. It is worth mentioning that Changan Bus and SINOTRUCK both accumulate to sell over 7000 units, with growth rates 190.78% and 233.7% in respective.

Table 2 Sales of main light truck manufacturers Jan.-Jun. 2013 (units, %)

|

No.

|

Company

|

Sales in first half 2013

|

Accumulative growth

|

Market share

|

Q2 2013

|

Year-on-year growth in Q2

|

Share of Q2 2013

|

Q2 2012

|

Share of Q2 2012

|

Year-on-year growth

|

|

Total light truck (inc. chassis)

|

1,004,004

|

5.04

|

100

|

513,308

|

10.31

|

100

|

465,344

|

100

|

0

|

|

|

1

|

Foton

|

203,943

|

-3.47

|

20.31

|

100,870

|

0.65

|

19.65

|

100,219

|

21.54

|

-1.89

|

|

2

|

JAC

|

123,365

|

8.23

|

12.29

|

62,758

|

12.31

|

12.23

|

55,880

|

12.01

|

0.22

|

|

3

|

Dongfeng

|

95,483

|

-3.69

|

9.51

|

54,434

|

19.17

|

10.6

|

45,678

|

9.82

|

0.79

|

|

4

|

Jinbei

|

81,433

|

15.84

|

8.11

|

46,165

|

37.41

|

8.99

|

33,596

|

7.22

|

1.77

|

|

5

|

JMC

|

72,748

|

3.92

|

7.25

|

36,898

|

6.03

|

7.19

|

34,801

|

7.48

|

-0.29

|

|

6

|

GWM

|

67,515

|

-3.51

|

6.72

|

36,087

|

0.13

|

7.03

|

36,041

|

7.75

|

-0.71

|

|

7

|

NAC

|

59,207

|

26.5

|

5.9

|

26,725

|

16.8

|

5.21

|

22,881

|

4.92

|

0.29

|

|

8

|

Qing Ling

|

34,624

|

-2.87

|

3.45

|

18,313

|

-1.94

|

3.57

|

18,676

|

4.01

|

-0.45

|

|

9

|

FAW

|

34,586

|

18.39

|

3.44

|

15,736

|

26.08

|

3.07

|

12,481

|

2.68

|

0.38

|

|

10

|

Hebei ZX Auto

|

33,970

|

10.81

|

3.38

|

16,843

|

9.2

|

3.28

|

15,424

|

3.31

|

-0.03

|

|

11

|

Tangjun Ouling

|

30,467

|

18.51

|

3.03

|

17,742

|

34.9

|

3.46

|

13,152

|

2.83

|

0.63

|

|

12

|

Shandong Kama

|

29,572

|

-11.52

|

2.95

|

12,983

|

-10.26

|

2.53

|

14,467

|

3.11

|

-0.58

|

|

13

|

Lifan Auto

|

27,045

|

85.6

|

2.69

|

11,766

|

40.96

|

2.29

|

8,347

|

1.79

|

0.5

|

|

14

|

Chongqing Changan

|

25,761

|

80.72

|

2.57

|

14,261

|

87.67

|

2.78

|

7,599

|

1.63

|

1.15

|

|

15

|

Zhejiang Feidie

|

14,429

|

-4.44

|

1.44

|

6,358

|

6.29

|

1.24

|

5,982

|

1.29

|

-0.05

|

|

16

|

Dandong Huanghai

|

12,446

|

4.77

|

1.24

|

6,289

|

5.66

|

1.23

|

5,952

|

1.28

|

-0.05

|

|

17

|

Sichuan Nan Jun

|

11,168

|

-33.74

|

1.11

|

5,739

|

-20.1

|

1.12

|

7,183

|

1.54

|

-0.43

|

|

18

|

BAIC

|

10,926

|

-28

|

1.09

|

6,537

|

-32.5

|

1.27

|

9,684

|

2.08

|

-0.81

|

|

19

|

Baoding Changan

|

7,918

|

190.78

|

0.79

|

4,104

|

138.74

|

0.8

|

1,719

|

0.37

|

0.43

|

|

20

|

SINOTRUK

|

7,515

|

233.7

|

0.75

|

2,999

|

110.75

|

0.58

|

1,423

|

0.31

|

0.28

|

In terms of ranking, Foton, JAC, Dongfeng, Jinbei, JMC, GWM, NAC and Qingling remain top 8 and maintain their same ranks over the first half of 2012. ZX Auto (No.10) and Zhejiang Feidie (No.15) also maintain the same ranking. For others, there 7 companies get promoted and 5 demoted. FAW rises to No.9 from No.11, Tangjun Ouling to No. 11 from No. 12, Lifan Auto from No. 16 to No. 13, Chongqing Changan from No. 17 to No. 14, Dandong Huanghai from No. 18 to No. 16, Baoding Changan from No.22 to No.19, SINOTRUK from No. 24 to No. 20. At the same time, Shandong Kama drops from No. 14 to No. 18, Jiangxi Changhe from No. 19 to No.21 and GAC GONOW from No. 20 to No.23.

Ⅲ Market Characteristics

In the second quarter of 2013, the light truck market presents following characteristics:

1. The total sales volumes in Q2 and first half year both increase, but the growth rate lower than heavy and medium trucks in the same periods.

2. In Q2 2013, the light market gets recovery, with sales volume surpassing the same periods of 2012 and 2011, only following to Q2 of 2010.

3. In Q2 2013, among top 20 companies, 16 companies see a sales volume higher than that in Q2 2012. Jinbei, FAW, Tangjun Ouling, Lifan Auto, Chongqing Changan, SINOTRUCK, and Baoding Changan maintain a growth rate over 30%.

4. The launch of new products is slower than Q2 2012 and Q1 2013. According to incomplete statistiscs, in Q2, only JAC launches new product Weiling II and Weiling 1061 on May 16. The two new types, besides upgrading back axle, power, transmission and tyre based on previous type of the same kind, increase the maximum speed to 122km/h and 115km/h. In Q1 2013, there are 11 types of new products open to service and in Q2, there are 8.

5. The notices, declaration and approval of light EV truck and light EV special vehicle are accelerated. According to statistics, in the first half of 2013, MIIT issues 5 notices involving 136 types of new-energy vehicles (48 more than the same period of last year), 27 types for light EV trucks and light EV special vehicles (11 more than the same period of last year). Products in the notices cover 9 electric cargo trucks and chassis, 6 electric transport vans, 7 electric garbage trucks, 2 electric watering carts and 2 electric fence trucks, and 1 electric sweeping trucks. In the first half of 2013, only NAC declares 17 electric special trucks, accounting for 63% (see Table 3).

Table 3 Approval of light EV truck and light EV special vehicle in first half of 2013

|

Model

|

Name

|

|

Model

|

Name

|

|

Model

|

Name

|

|

NJ1027PBEVAL

|

Electric truck

|

NJ5027XXYEVL

|

Electric transport van

|

ZLJ5160GSSCABEV

|

Electric watering cart

|

||

|

NJ1027PBEVAL

|

Electric truck chassis

|

NJ5027XXYEVS

|

Electric transport van

|

ZLJ5072TSLBEV

|

Electric sweeping truck

|

||

|

NJ1027PBEVALS

|

Electric truck

|

NJ5027XXYEVLS

|

Electric transport van

|

LQG5022CCYBEV

|

Electric fence truck

|

||

|

NJ1027PBEVALS

|

Electric truck chassis

|

NJ1027PBEVNZ1

|

Electric truck chassis

|

LQG5023CCYBEV

|

Electric fence truck

|

||

|

NJ1027PBEV

|

Electric truck

|

NJ5028XTYEV1

|

Electric closed drum garbage truck

|

LQG5021ZLJBEV

|

Electric lifter garbage truck

|

||

|

NJ1027PBEV

|

Electric truck chassis

|

NJ5028ZZZEV1

|

Electric lifter garbage truck

|

HHR5022ZXXBEV

|

|||

|

NJ1027PBEVS

|

Electric truck

|

NJ5028XTYEV

|

Electric closed drum garbage truck

|

JHL5162GSSEV

|

Electric watering cart

|

||

|

NJ1027PBEVS

|

Electric truck chassis

|

NJ5028ZZZEV

|

Electric lifter garbage truck

|

ZN5080ZYSA5CBEV

|

Electric compression refuse collector

|

||

|

NJ5027XXYEV

|

Electric transport van

|

QY5020XXYBEVECCB

|

Electric transport van

|

ZWQ5001BEV

|

Electric transport van

|

Ⅳ. Expectation in the second half year

Looking into the second half year, the economy is likely going downward, so the demands in domestic market remain low. A 2% growth is expected in the second half year over the first half year. There are several reasons to support the expectation:

1. The overall economy is likely going downward. On July 9, on a forum regarding economical situations in some provinces held in Guangxi, Premier Li Keqiang stresses that the macro control, standing from the present and bearing future in mind, should make economical operation in a rational scope—economic growth rate, employment rate, and the margin of price rise should be confined within limits. This indicates a rapid economic growth in the second half year is out of hope.

2. Emission standard is upgraded. In political level, on June 14, at the executive meeting of the State Council, ten measures to prevent air pollution are passed. Locally, from July 1, some cities begin to implement China Ⅳ for diesel vehicles. Many cities accelerate the speed to eliminate “yellow label car” (referring to highly polluted vehicles) and driving limits on trucks. As diesel light trucks save almost half of fuel than gasoline vehicles, 99% light trucks are diesel ones. The implementation of China Ⅳ standard in the second half year will exert direct impact on the sales of light trucks.

According to statistics, by the end of June, only Zhanjiang (Guangdong province), Qingyuan (Guangdong province), Nanjing (Jiangsu province), Lanzhou (Gansu province) and Pingling (Gansu province) make clear to implement China Ⅳ standard for light diesel vehicles. 28 cities formulate to implement China Ⅳ standard for diesel vehicles (including light ones), namely, Shanghai, Guangzhou, Chengdu (Sichuan), Meishan (Sichuan), Ya’an (Sichuan), Suqian (Jiangsu), Wuxi (Jiangsu), Huaian (Jiangsu), Yixing (Jiangsu), Bengbu (Anhui), Haikou (Hainan), Sanya (Hainan), Urumqi (Inner Mongolia), Quanzhou (Fujian), Ningbo (Fujian), Wenzhou (Zhejiang), Hangzhou (Zhejiang), Qingyang (Gansu), Wuhan (Hubei), Yichang (Hubei), Jincheng (Shanxi), Yinchuan (Ningxia), Zhengzhou (Henan), Hebi (Henan), Shangqiu (Henan), Nanyang (Henan), Pingdingshan (Henan), and Xuchang (Henan).

Detailed information about implementation of China Ⅳ for diesel vehicles:

Northeast (including Heilongjiang province, Jilin province and Liaoning province): only Harbin carries out the standard for heavy gasoline and diesel vehicles with gross mass over 3.5t.

North China (including Beijing, Tianjin, Hebei province, Shanxi province and Inner Mongolia): only Beijing carries out the standard for heavy diesel vehicles but the light diesel vehicles remain to conform to China Ⅲ standard.

East China (including Shandong province, Jiangsu province, Anhui province, Zhejiang province, Jiangxi province, Fujian province and Shanghai): among 106 cities in this region, 12 cities implement the standard, namely Shanghai, Nanjing, Hangzhou, Suqian, Wuxi, Huaian, Bengbu, Ningbo, Wenzhou, Quanzhou, Yixing and Huzhou (Zhejiang province).

Middle China (including Henan province, Hubei province, Hunan province): among 52 cities in this region, only 9 cities implement the standard, namely Zhengzhou, Hebi, Shangqiu, Nanyang, Pingdingshan, Xuchang, Wuhan, Yichang and Xiangtan (Hunan province).

South China (including Guangdong province, Hainan province, Guangxi province, Hong Kong, and Macao): except two special administrative regions, among the 51 cities, 9 cities implement the standard for diesel vehicles, namely Guangzhou, Shenzhen, Zhongshan, Huizhou (Guangdong), Zhanjiang, Qingyuan, Foshan (Guangdong), Haikou and Sanya.

Southweast (including Sichuan, Yunnan, Guizhou, Chongqing and Tibet): among 60 cities, only 3 cities implement the standard, namely Chengdu, Meishan and Yaan.

Northwest (including Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang): among 53 cities, only 7 cities implement the standard, namely Xi’an, Yinchuan, Lanzhou, Xining, Qingyang, Pingliang, and Urumqi.

According to incomplete statistics, only 9 cities could supply China Ⅳ-compliant diesel, namely Beijing, Shanghai, Guangzhou, Foshan, Zhongshan, Shenzhen, Dongwan, Huizhou and Chengdu. According to “Vehicle Diesel Ⅳ”GB19147-2013 issued by General Administration of Quality Supervision and Standardization Administration, sulphur content should be less than 50ppm in the Ⅳ stage till December 31, 2014. However, the supply of 350ppm (China Ⅲ standard) is commenced on July 1, 2013.

Supply of Adblue: according to the notice of Standardization Administration—Diesel Motor Nitrogen Oxides Reductant—Adblue (AUS32) is officially implemented on July 1.

The above indicates that the implementation of China Ⅳ brings a lot of trouble to vehicle manufacturers and user.

3. The shortage of money affects not only the development of micro and small companies but also vehicle loans. Even the state council formulated the guidance on financial support for economic structure adjustment and transformation upgrading, it is implemented at the end of the year, thus it will not have too much influence.

4. July, August and September are off seasons for commercial vehicles. There is no exception for this year. Therefore, there are only three month left to see actual sales.

5. Foreign trade is severe affected by various reasons. First of all, the external market remains depressed, limiting the export of vehicles. Secondly, exchange rate, labor and export costs continue to rise, making it harder for exporting. Thirdly, as the trade friction happens frequently in various ways, China’s trade environment is taking a turn for the worse. Last but not least, industrial production in China slows down, hindering the demands for imports of raw materials.

- Analysis and Anticipation on Chinese Medium Truck Market in Q3 2013 2013-11-26

- Sales Analysis on Foton Products in September 2013-10-18

- Analysis on Sales of Micro Truck Manufacturers in July 2013 2013-08-26

- Analysis on Sales of LD Truck Manufacturers in July 2013 2013-08-26

- 2010 Special Report on China Truck Market Outline 2010-07-20

- 2009 Special Report on China Truck Market Outline 2009-06-23

- China heavy truck market analysis in the first 8 months of 2008 2008-09-25

- WEICHAI NECV: Building Global Trust through Quality and Service 2025-01-27

- LANDKING R Mini Trucks: Compact, High-Capacity, Ideal for City Travel 2025-01-22

- XCMG Exports 300 Heavy Trucks to High-End Overseas Market 2025-01-20

Submit Your Requirements, We Are Always At Your Service.

- Zhizi Auto Successfully Holds 2025 Product Launch Event

- FAW Jiefang and CATL Sign Strategic Partnership Agreement

- Driving Green Economy Forward: ABA Bank Partners with ZO Motors Cambodia

- Farizon SV Sets New Safety Standard with Euro NCAP Platinum Rating

- Chery Commercial Vehicles Launches New Heavy Truck Platform

- JAC Listed on China’s Top 100 Global Brands

- FAW Jiefang Strengthens Global Reach with a Focus on Uzbekistan

- COMTRANS 2024 Opens in Moscow

- JAC Advances in Australia: Expanding Electric Trucks in 2024

- Foton Launches “IECO” Brand: A New Era for Smart CV Ecosystem

- November 2024: Heavy Truck Sales Hit New Highs

- November 2024: New Energy Light Truck Sales Hit 14,000 Units in China

- November 2024 Sees Surge in New Energy Heavy Trucks in China

- Heavy Truck Sales Reached 56,000 units in First Three Quarters 2024

- Heavy Truck Sales in September 2024

- Heavy Truck Sales Reach 59,000 Units in July in China

- Tractor Sales in H1, 2024 Reached 162,100 Units, Up 4%

- China's Truck Export Reaches 351,076 Units in H1 2024

- XCMG Dominates 2024 with Record Sales in New Energy Heavy Trucks

- Mid-Year Pickup Market Report: JAC Exports Up 13%, JMC Exceed 36,000 Units